Download het BPM Partners-whitepaper

Finance meets its first autonomous agents

Relive the launch: agents, insights, and the future of finance.

september 25, 2025Finance meets its first autonomous agents

On September 23, 2025, we gathered finance leaders, analysts, and customers from around the world to reveal the future of finance. Broadcast live from theCUBE, the launch celebrated a new era of Autonomous Finance with the Prophix One Agents, where human strategy meets AI execution.

Our President and CEO, Alok Ajmera, opened with urgency: “Organizations are employing their most professional finance leaders in incredibly manual processes, repetitive tasks and they are spending a bunch of their time just wrangling information, hunting down answers. It's not about inefficiency; it's actually about missed opportunity.”

He described this moment as an inflection point. Generative AI has moved us from simply streamlining tasks to making them fully autonomous, shifting work from eight hours down to zero. For CFOs, that means an entirely new operating model.

Alok framed the vision for autonomous finance around three pillars: real-time insights that surface anomalies proactively, accelerated decision-making with scenarios built in the moment, and a finance office that operates as a true strategic partner to the business.

“What would you do if you could hire an unlimited number of financial analysts?” he asked. “That’s the opportunity agentic AI puts in front of finance leaders today.”

Inside the office of the CFO

Before our customers see the latest innovations within the Prophix One platform, our finance team does. As “customer zero,” Prophix CFO Aaron Levine has tested the agents in his own workflow.

“Being ‘customer zero’ gives us a massive advantage,” Aaron said. “We get to validate the product delivers on its promise and prove it’s built for finance, by finance.”

“It’s completely transformed the way our team works,” he shared. “We’ve gone from spending a huge amount of time on data reconciliation and historical reporting to focusing on advanced modeling and running what-if scenarios. The Agents are handling the tedious, repetitive tasks, which has given my team a whole new level of capacity.”

For Aaron, that shift is about more than productivity gains, it has changed the role of finance itself. “It’s really about focusing on the ‘A’ in FP&A,” he explained. “We’re spending more time on analysis, guiding the business with forward-looking insight.”

That change is both operational and cultural. Conversations are no longer about what happened last quarter, but about what the business should do next. “This new confidence in our numbers is a direct result of using a platform that understands finance so deeply,” he said.

He also noted that finance is no longer simply the “keeper of the numbers.” With AI agents offloading routine tasks, finance becomes a true partner to the business, embedded in decision-making and helping shape strategy across the organization.

Meet the agents

At the heart of the launch was the debut of the brand-new Prophix One Agents:

- Budgeting Agent: Automates your budgeting cycle from manual setup and to guided collaboration in seconds.

- Reporting Agent: Generates variance analysis and presentation-ready reports for executives.

- Modeling Agent (coming soon): Creates and maintains connected financial models.

In a live demo, the Budgeting Agent kicked off a company-wide process instantly, while the Reporting Agent produced a board-ready variance report complete with analysis and draft narrative.

Chief Technology Officer Anurag Yagnik explained what was happening behind the scenes: “These agents are self-directed software designed to achieve specific finance goals. You set the parameters, and they orchestrate the tasks across data, workflows, and tools eliminating what would otherwise take hundreds of hours manually.”

That product foundation set the stage for Chief AI & Trust Officer Geoff Ng, who emphasized why this model matters for finance leaders. “At its core, Prophix One Intelligence is a suite of AI services natively embedded into our platform. It acts as a centralized intelligence engine that powers planning, reporting, and close with explainable, enterprise-grade AI. Our platform has been architected to be future-ready designed for scale, performance, and innovations like agentic AI, so our customers can grow with confidence.”

As Geoff explained, the outcomes come down to three things: clarity, capacity, and confidence. Clarity showed up in the demos, where answers came instantly instead of through hours of manual work. Confidence is anchored in explainable, auditable outputs, a non-negotiable for finance leaders. And capacity is where the change becomes most visible: freeing teams from the grind so they can lead with strategy.

Making those outcomes real requires trust and that’s built directly into the technology itself. Prophix One Agents operate on a “glass-box” model, where every action is logged, explainable, and under customer control. Features can be switched on or off, guardrails are tested for fairness, and customer data is never used to train external foundation models thanks to AWS Bedrock integration.

Geoff underscored that this commitment is independently verified: Prophix has earned TrustGuard’s Responsible AI Certification, aligning with leading global standards across the EU, ISO, and other frameworks. “Trust isn’t an add-on. It’s built into the architecture from day one,” he said.

Customers and analyst perspectives

The benefits Aaron described are already being echoed across customer teams. For Mandy Huynh, Business Intelligence Analyst at KBL Environmental, Copilot has become her “one-stop shop for answers,” used daily to help her team shift from reactive reporting to proactive planning.

For Erika Jones, Finance Reporting and Analysis Manager at Lee Company, the advantage is speed and independence. She described finally having “a quick way to refresh my memory and get answers within seconds.”

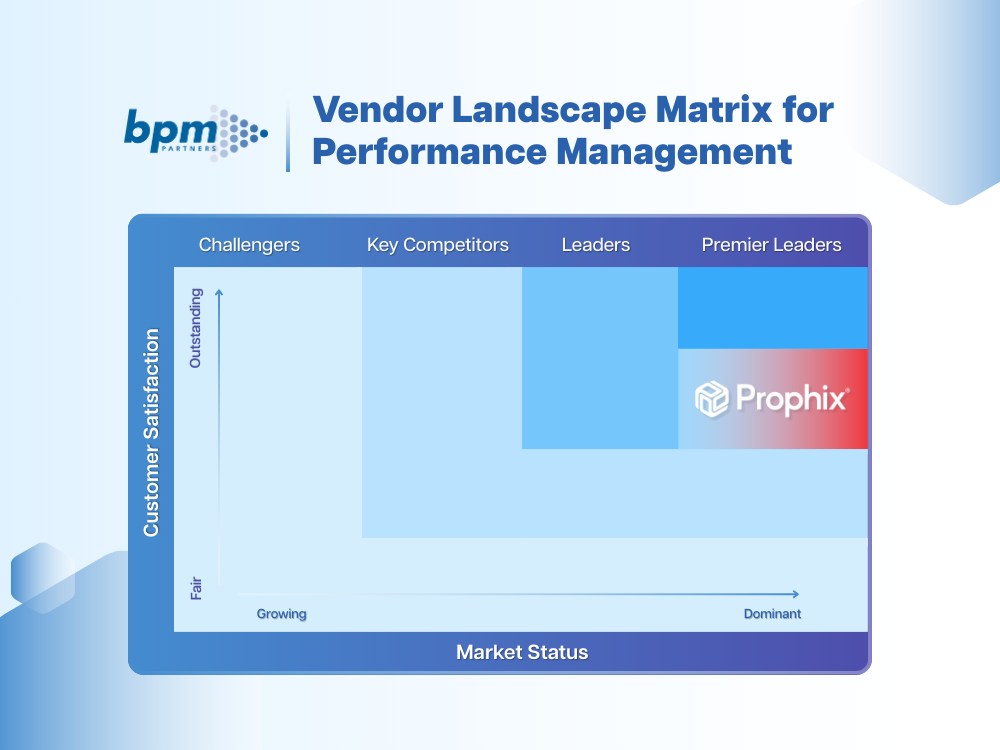

Industry analyst Craig Schiff, Founder, President and CEO of BPM Partners, confirmed what we’ve been hearing from CFOs across sectors: “When we look at new performance management systems, AI has got to be there. Something we hear a lot from CFOs is we want to grow, but we don’t want to grow finance in lockstep with the company. Agentic AI has the potential for you to do more with the staff you already have.”

Want deeper insights into how CFOs are approaching AI?

Download the BPM Whitepaper →

Looking ahead

Our Chief Marketing Officer, Vidhya Srinivasan, closed the event by grounding the launch in what matters most: access and adoption. Prophix One Agents, she confirmed, will be available to customers by the end of September 2025. For current Prophix One users, the agents will appear automatically once they consent to use AI. No re-platforming, no extra implementation.

She reiterated what sets this launch apart: “Trust, security, and privacy are non-negotiable in the way we’ve architected Prophix One. With explainable, glass-box AI, finance leaders can see exactly how agents are working and stay firmly in control.”

That foundation, combined with a modernized, future-ready platform, means customers can begin scaling capacity and building confidence from day one. “Ultimately, it’s not about buzzwords, it’s about delivering autonomous finance through a platform designed for clarity, capacity, and confidence,” she said.

For those eager to see more, Srinivasan pointed to the upcoming Prophix Live! event in London, where finance teams will get hands-on experience with agents in action.

Watch the launch on-demand

Inzichten voor de volgende generatie financiële leiders

Blijf voorop met actiegerichte financiële strategieën, tips, nieuws en trends.